unemployment tax credit refund

Ad Access IRS Tax Forms. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer.

When Will The 2021 Child Tax Credit Payments Start Under Stimulus Relief The Turbotax Blog

On May 14 the IRS announced that tax refunds on 2020 unemployment benefits would begin to be deposited into taxpayer bank accounts within the week.

. The agency said last week that it has processed refunds for 28 million people who paid taxes on jobless aid before mid-March when Democrats passed the 19 trillion American Rescue Plan. The IRS has been unresponsive. Some tax credits are refundable meaning that if the amount of your credit is more than the amount of your taxes due you will receive the difference back from the government in the form of a refund.

WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. Ad File your unemployment tax return free. For some there will be no change.

Child Tax Credit Receiving unemployment income wont prevent you from claiming the Child Tax Credit. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in. For this round the average refund is 1686 direct deposit refunds started going out Wednesday and paper checks today.

But the unemployment tax refund can be seized by the IRS to pay debts that are past due. 22 2022 Published 742 am. The Child Tax Credit is worth up to 2000 per qualifying child with a refundable portion of up to 1400.

In the For Period Beginning field enter the first day of the pay period that the refund affects. IR-2021-159 July 28 2021. Unemployment and tax credit rules.

100 free federal filing for everyone. The unemployment tax refund is only for those filing individually. They dont need to file an amended tax return.

By Anuradha Garg. Go to the Employees menu and select Payroll Taxes and Liabilities and click Deposit Refund Liabilities. The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits.

The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. People who received unemployment benefits last year and filed tax returns on that money could receive the extra funds the IRS said in a press release. So far the refunds are averaging more than 1600.

This includes unpaid child support and state or federal taxes. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. Premium federal filing is 100 free with no upgrades for premium taxes.

There are some exceptions. Most taxpayers will receive their unemployment refunds automatically via direct deposit or paper check. But 13 days.

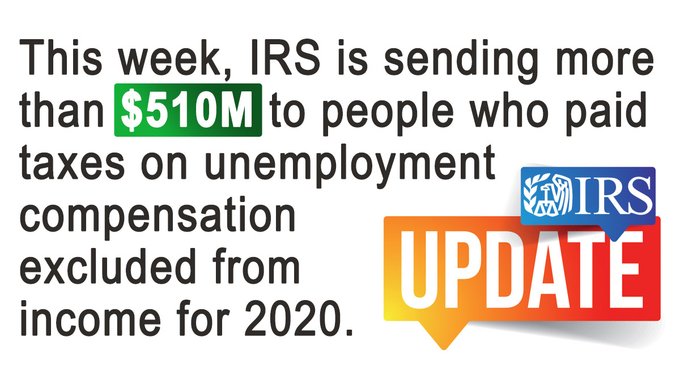

The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their 2020 tax returns. The IRS has sent letters to. However because this credit reduces the tax you owe you must have some taxable income to claim it.

The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. Some taxpayers will receive refunds which will be issued periodically and some will have the overpayment applied to taxes due or other debts.

The Earned Income Tax Credit EITC is a refundable tax credit for low-to-moderate income workers who have worked and earned income under the amount of 57414. IRS to begin issuing tax refunds for 10200 unemployment break Households that earned less than 150000 last year qualify for the tax break regardless of filing status. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. In the Refund Date field enter the deposit date. Check For The Latest Updates And Resources Throughout The Tax Season.

Complete Edit or Print Tax Forms Instantly. Select the name of the vendor who submitted the refund check.

Interesting Update On The Unemployment Refund R Irs

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Compensation Are Unemployment Benefits Taxable Marca

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

Irs Refund Status Unemployment Refund Schedule Is Delayed Marca

Taxes Q A How Do I File If I Only Received Unemployment

How Many Tax Refunds Did The Irs Issue In July What S The Timeline To Receive It As Usa

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

Unemployment Tax Break 2022 A New Unemployment Income Tax Exclusion Coming Marca

Confused About Unemployment Tax Refund Question In Comments R Irs

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Unemployment Tax Refund Will You Get A Refund For This Benefit Marca

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

Stimulus Payments Start To Arrive The Latest On The Coronavirus Relief Bill The New York Times

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Tax Break Surprise 581 Checks Paid Out To 524 000 Americans In Time For New Year S Eve Marca